41+ can you roll closing costs into mortgage

Ad Get an Affordable Mortgage Loan With Award-Winning Client Service. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Realtor Fee Included In Closing Costs At Shannon Cordes Blog

Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

. When it comes to VA loans your closing costs can include. Web Closing costs for US. Web When you roll your closing costs into your mortgage refinance loan youll have to pay interest on that money the entire time youre paying off your home loan.

A VA funding fee. When you buy a home you typically dont have an option. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Web Yes closing costs can be included in a mortgage loan. Your monthly mortgage payment would elevate by 50 per month. Web Closing costs for a purchase loan can typically run about 2 6 of the homes purchase price.

Department of Veterans Affairs VA loans. Along with most applicable conventional loan fees VA loans require a funding fee. Web FHA loans require a borrower to pay an upfront mortgage insurance premium which is usually 175 of the loan amount and it can be rolled into the loan.

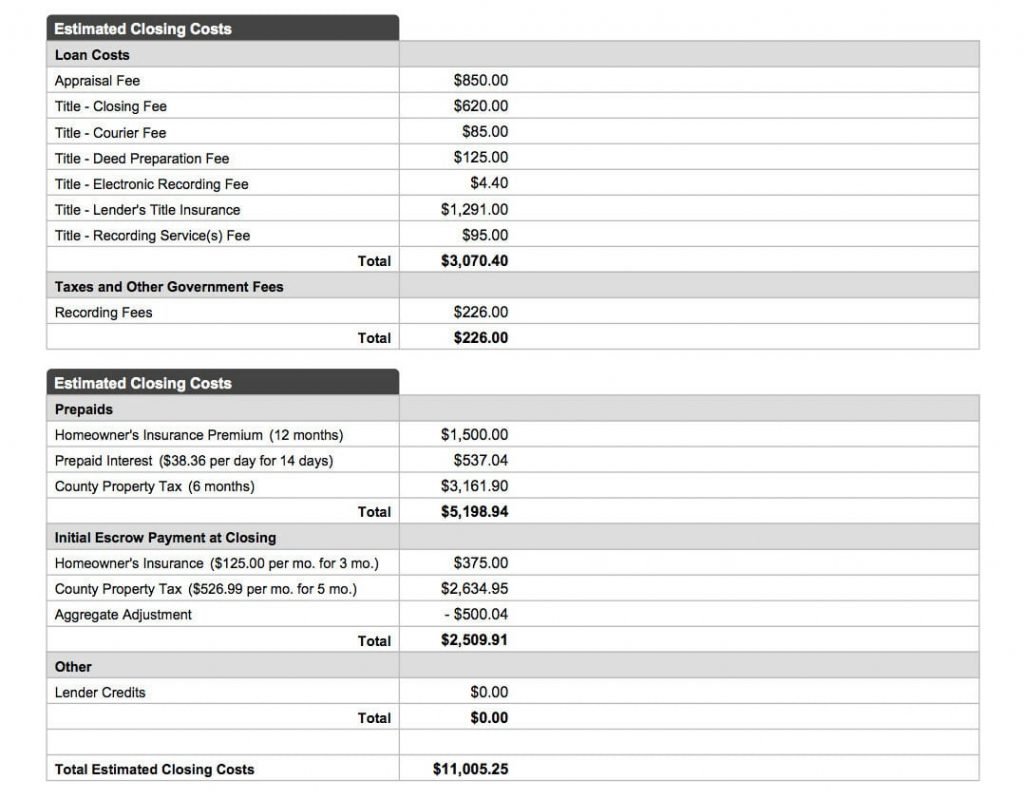

But you must have a. Compare Loan Options and Compare Rates. About three days before closing youll receive your Closing Disclosure which will list your closing costs.

Web Can I roll in my closing costs when I refinance. Web That means for a 300000 mortgage VA closing costs could be anywhere from 3000 to 15000. USDA loans allow seller concessions up to 6 of the sales price.

Web The sum closing costs on your new mortgage is 10000 You have a 5 interest rate on a 30-year term. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. According to the Consumer Financial Protection Bureau CFPB the average.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web Mortgage closing costs roll many fees into one. The downside of rolling closing costs into a loan is that you.

Typically these equal 2-4 of your loan amount and. Rolling closing costs into your new loan is known as a no-cost refinance and may be a good strategy if your short-term. Ad Calculate Your Payment with 0 Down.

Web According to Freddie Mac you can expect to pay 2 to 5 of the mortgage loan in closing costs. A loan origination fee. This is also known as rolling closing costs into a loan.

435 41 votes Most lenders will allow you to roll closing costs into your mortgage when refinancing. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Mortgage Hacks To Painlessly Pay Your Mortgage Off Early

Can You Roll Your Closing Cost Into Your Mortgage Loan Youtube

Home Buyers Closing Cost Calculator Mls Mortgage Closing Costs Mortgage Home Loans

Can You Roll Closing Costs Into A Mortgage The Money Boy

Closing Costs Calculator Estimate Closing Costs At Bank Of America

Can You Roll Closing Costs Into A Mortgage The Money Boy

Business Credit

Can You Roll Closing Costs Into A Mortgage

Can You Roll Closing Costs Into The Mortgage Banks Com

Huge Price Appreciation And Trying To Buy A House Steps To Follow

Pdf Solution Manual Cost Accounting William Max Choi Academia Edu

Buyers Can T Roll Closing Costs Into Their Loan Options Jvm Lending

Should You Roll Closing Costs Into Your Loan When Refinancing Coast2coast Lending

Can You Roll Your Closing Cost Into Your Mortgage Loan Youtube

Ramona Sentinel 11 19 15 By Utcp Issuu

Can You Roll Closing Costs Into A Mortgage Valuepenguin

Krec License Law Manual Kentucky Real Estate Commission